Wealth Commandment #1: Closer Over More

Every decision must get us closer to what we want.

Certainty U has 4 core Wealth Commandments. They are “commandments” because, in order to get what you want, you must not violate them. The cognitive distortions and biases hardwired into us at birth make this much easier said than done. We are, for example, hardwired to believe that “more” is the solution to everything. There are plenty of anecdotes about how chasing more has gotten people further away from the things that actually matter to them.

Instead of another story, let’s explore what “closer vs more” might look like and how it might be measured. We’re going to use an example, below, you can get your free account and enter your own numbers or do something similar on paper or a spreadsheet.

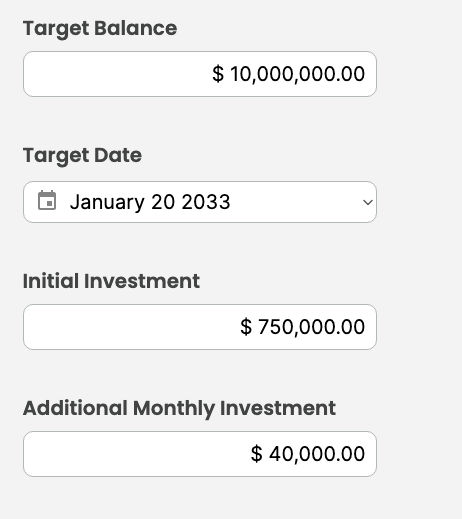

First, we need to be honest about where we are now, where we want to be, and an appropriate timeline. Example:

Where we’re at:

“I have $950,000 in savings and have a consistent $45,000 a month I can invest”

Where we want to be and an appropriate timeline:

“I want to pay off my home and never have to work again, if I don’t want to, in the next ten years”

Then, we have to turn those priorities into something we can solve for; a dollar amount. Let’s say given our best estimate we will need an extra 10 million dollars in 10 years to achieve the priorities above. It would look like this:

What we have done is create a simple version of Dan Nicholson’s Solvable Problem.

Why is this important?

Because Wealth Commandment #1 states that every decision we make must get us closer to what matters most to us and the solvable problem helps us discern how much risk to take when to take risk off the table, and how to best allocate our resources to give us the highest probability of getting what we want.

Not the most possible, the highest probability of getting what we want.

The Certainty App shows us that if we are taxed at 40% we will need a 12.6% annual return to reach our goal:

This tells us how much risk we need to take and when to take risk off the table. If we invest in assets that average 4% a year we will not reach our goal in the timeline we deem appropriate. If we are taking a significant amount of risk attempting to get 30% per year, we are taking far more risk than necessary.

It also tells us where we can increase the probability of getting what we want in simple ways. For example, a little tax planning might drop your tax rate down to 20%:

Now, we would only need 9.5% a year. We could also go through Dan’s famous two-oreo principle exercise (eliminate all unnecessary recurring expenses) and find another $3,000 a month that can be reallocated to the top priorities:

Again, we’ve dropped the return we need to reach the things we deem most important. In other words, our actions are focused on getting closer to what we actually want instead of chasing more. Chasing “more” leads to unnecessary risk and drives down the probability of achieving the most important things.

This is just a new way to look at reaching your goals. In the coming days, weeks, and months, Certainty Tools will be sharing many of the tactics and strategies (like the two oreo principles) to help you get closer to what matters most.

If you want to play with the math you can sign up for a free Certainty App account here.

The app is still in beta but the calculator above is available for everyone to use for free, it’s the “Solvable Problem” tool shown here:

More resources to help with Wealth Commandment #1 coming soon. In the meantime, practice thinking in terms of “closer” instead of “more”

Certainty U

PS. We’ve added a new tab for free downloads. We will continue to add to it as time allows. Feel free to download, print and/or share what is useful.